Tax News

The C Corp Leasing Company: Why It's Not the Tax Haven It Seems

Who wouldn’t want to drop their tax rate by over 15% simply by setting up a new company and moving some money around?

When S Corps and Real Estate Don’t Mix: What Every Investor Should Know

The Hidden Consequences of S Corporations and Rental Real Estate

Decoding Financial Advising: How Do Planners Get Paid?

How do financial planners make money?

The Future of Taxes: How ChatGPT4 Could Change the Game

Did taxes just get easier? How ChatGPT4 and other AI may make taxes less…taxing.

Donating Stock vs. Cash: The Tax-Saving Strategy You May Be Missing

If you’re sitting on stock that’s increased in value, donate the stock rather than cash for an added tax benefit.

3 Harsh Truths about Disability Insurance: Why Your Coverage May Not Be Enough

If we give it any thought at all, we expect our disability policies to kick in if we can’t work. But are we truly covered?

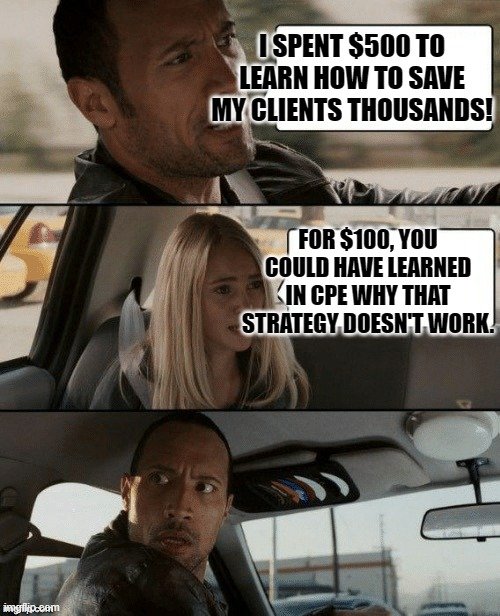

Tax strategy “influencers” - can they deliver on their promises?

Tax strategy “influencers” claim they can quickly teach aspiring tax professionals how to save their clients meaningful tax dollars. But can they?

What’s up with the “fair tax”?

There’s a lot of talk about a “fair tax”. What is it? Is it truly “fair”?

Does your non-profit actually have tax-exempt status?

You may be operating your organization as if it’s a non-profit, but does it ACTUALLY have non-profit status with the IRS? Make sure you have this documented.

Spotting bad tax advice on social media

Going to social media for tax advice? Hey, it’s not a bad place to start. Just…be careful.

SECURE Act 2.0 changes to IRA required minimum distributions

The SECURE Act 2.0 makes many changes to retirement plans. One change is required minimum distributions being pushed out.

Do I need to pay Estimated Taxes?

Many of our clients make estimated tax payments. Part of our job is to help them determine when to make these payments and how much to pay. What are estimated taxes and how do they apply to you?

An Introduction to Tax Strategy for Multi-Generational Wealth

Saving tax dollars often isn’t just about lowering what you owe this year or even lowering the next several years of tax bills. It’s about lowering taxes across your entire family for as long as possible.

A State-Level Solution to the Federal SALT Limitation

If you’ve been paying taxes for the past few years, you are likely well-acquainted with the cap on deducting state and local taxes (SALT) on your personal tax returns. This limitation was part of the Tax Cuts and Jobs Act of 2017.

When S Corporations Cost You

In my continued efforts to educate the American taxpayer on our needlessly complicated tax system and debunk tax myths, this article provides multiple, common examples of when it would be less desirable to do business as an S Corporation than another option such as a sole proprietorship/single member LLC (businesses with one owner) or a partnership (businesses with multiple owners).

Build Back…Something…A Last Look at 2021 Taxes

With the end of the year quickly approaching and the Build Back Better bill still stuck in the Senate, what should you do? Here, we’ll discuss tax provisions currently in the bill that could impact you, what moves you may want to make over the next few weeks, and general year-end tax planning.

Helping Someone Else with Their Taxes

When you’re helping someone whose mental or physical health is declining, they often try to retain as much independence as they can and continue to do as much for themselves as they can. This may include continuing to handle their taxes themselves – whether this is using an online tax preparation platform or interacting with their tax advisor. This can be problematic for several reasons.

Understanding Self-Employed Retirement Plan Options

One of the topics my self-employed and small business clients consistently ask me about is retirement plan options. When you’re an employee, it’s likely your employer has a retirement plan established and you make your desired contribution without giving too much thought about the plan itself. However, when it’s your company, choices must be made.