Understanding Self-Employed Retirement Plan Options

One of the topics my self-employed and small business clients consistently ask me about is retirement plan options. When you’re an employee, it’s likely your employer has a retirement plan established and you make your desired contribution without giving too much thought about the plan itself. However, when it’s your company, choices must be made. The questions I receive are typically:

What type of plan(s) are available for my situation and which plan(s) should I have?

How much should I contribute?

What are the tax benefits of contributions?

Spoiler alert: this article won’t necessarily answer these questions for you. Instead, it will provide you with foundational information so you can have an informed conversation with your tax and financial advisors. They will help you match your current and long-term tax and financial goals against your available retirement plan options. Making optimal choices around retirement plans without help from your financial team is a difficult, if not impossible, task.

Options

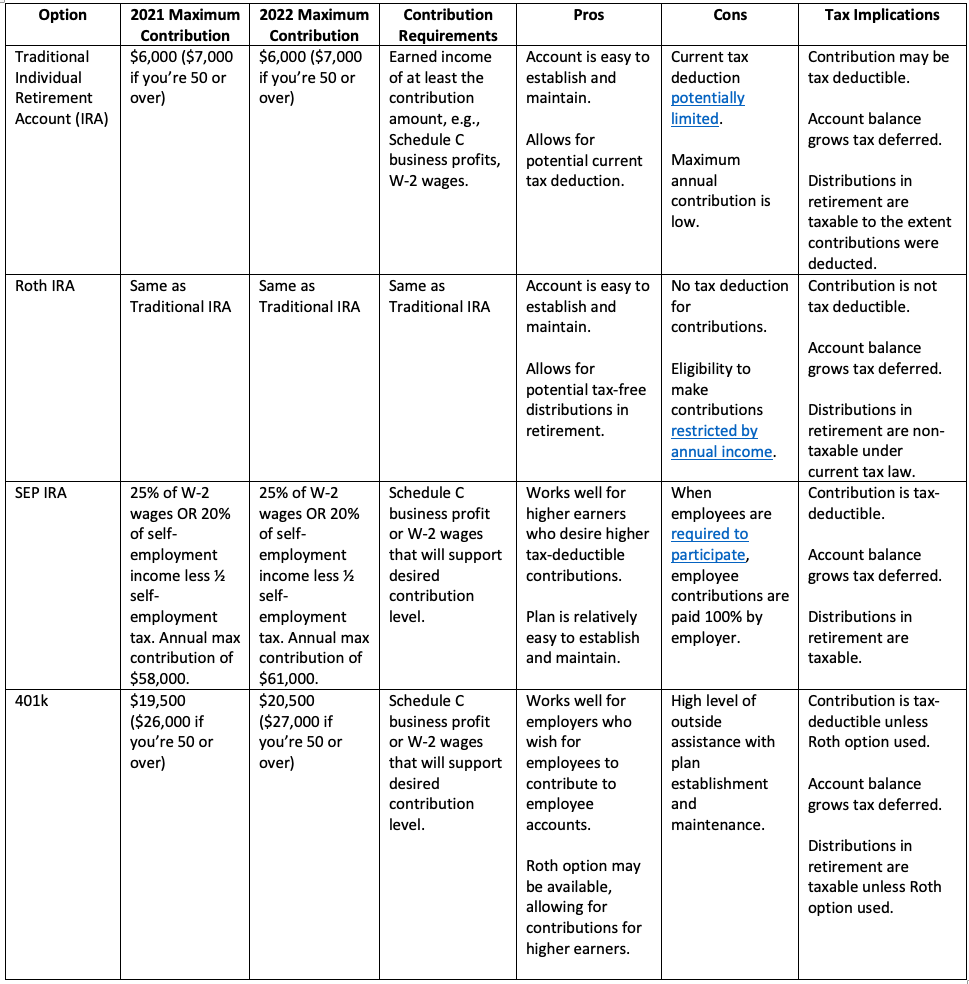

There are quite a few retirement plans available for small businesses. Some may obviously not work for your situation. Some can be used alongside other plans. A suitable plan for you one year, may not work for you the next. Whether so many choices are a feature or a bug will depend on your perspective.Here’s a quick overview of retirement plans most commonly used by small businesses. In summary, I typically see:

Solo401ks and SEP IRAs used by folks who don’t anticipate employees and want to put as much away as they can.

Traditional IRAs reserved for those who are short on free cash. If you can’t put much in, there is no sense in establishing a retirement plan that requires more work and higher costs.

Roth IRAs reserved for those who will have income low enough to allow for the contribution. I occasionally see this option used in conjunction with a SEP/Solo401k which are used to get income down low enough to allow for the Roth.

SIMPLE IRAs not used as much. Most clients with employees generally gravitate to a 401k for the additional bump in contribution over the SIMPLE.

Defined benefit plans as an option but rarely used. These are an entirely different creature that are suitable for businesses with huge profits, the right composition of owner to non-owner compensation, plus other factors. Use these when you have the right fact pattern, want a current tax benefit, and have so much free cash you don’t know what to do with it.

Factors

How much do you want to contribute? No sense in establishing a SEP IRA if you only want to contribute $4,000 this year.

How old are you? Age can impact contribution eligibility and level.

Do you have employees? Whether by choice or by requirement, including employees in a retirement plan will impact your selection.

What level of business income do you expect? For Schedule C filers, contributions are limited by business profits. If you expect a loss for the year, you will likely not be able to make a retirement plan contribution.

Is your business an S Corporation? Your contribution will be limited by your S Corporation W-2 wages.

What are your financial goals? Is current tax minimization a high priority? Or is it more important to be growing a “bucket” of potentially tax-free retirement income? As my clients hear me say frequently – if you don’t know where you’re going, any road will get you there. It’s important to understand how your retirement plan selection, or lack thereof, fits into the bigger picture of your overall financial health. It’s also helpful to consider that the majority of retirement plan options will only allow for pre-tax contributions which may or may not be desirable for your long-term financial plan.

Are there other retirement plans in place? Whether you’re leaving a former employer mid-year, or your business has established multiple retirement plan types, working with different plans within the same year can be a benefit or a hindrance depending on your particular circumstances.

How much time, money, and energy are you willing and able to put toward establishing and maintaining a retirement plan account? The more resources you can devote, the more robust your plan can be (to an extent).

Contribution Timing

A note on contribution timing. I generally recommend clients wait until their tax returns have been solidified to contribute to plans that require income levels to be known, e.g., Roth IRA, SEP IRA for Sch C, etc. This prevents the headache of having to undo contributions that, ultimately, aren’t allowed once it’s known that the profits aren’t there to support the previously made contribution. You may want to, or even need to, establish your plan during the tax year. But actually funding the plan can take place in conjunction with preparing that year’s tax return in the following year.For example, you file your business activity on Schedule C of your personal tax return. You have established a SEP IRA for 2021 and wish to maximize your 2021 contribution. You can wait until your 2021 tax returns are prepared in early 2022 to determine the exact maximum you can contribute, and then fund the account in 2022.For another example, you have a Solo401k plan established for your S Corporation. You are permitted both an employee contribution based on your W-2 wages and an employer match of up to 25% of your W-2 wages subject the annual limit. You know you’ll maximize your 2021 employee contribution but aren’t sure if you will do the same for the 2021 employer match. As the 2021 employee contribution will be reported on your 2021 W-2, it will need to be contributed during 2021 (or possibly shortly thereafter). However, the 2021 employer matching portion can be decided by the due date of your 2021 tax return in 2022, so you can wait for your tax return results before deciding on and funding your employer contribution in 2022.

What’s Next?

There’s so much more that can be said about retirement plan options. As stated previously, this article isn’t meant to provide your optimal answer, but rather to provide you with the fundamentals so you can have a more in-depth conversation with your tax and financial advisors. Start that conversation now to head toward a retirement plan that’s right for you.